This article originally appeared on LinkedIn.

Discover’s deep customer commitment

The slogan of Discover Financial Services’ TV ads is “We treat you like you’d treat you.” Here are some examples of that treatment of employees and customers that I learned of while researching Winning on Purpose:

- Discover’s executives do not treat call centers as a cost but as an opportunity to strengthen customer relationships, encourage card usage, and build loyalty. They invest in digital solutions for simple customer issues to reduce call volume and free employees to focus on complex situations.

- Customer service is handled 100% by Discover employees at US locations 24/7, 365 days a year. Customer service reps are well paid, well trained, and well treated, for example, receiving the same medical coverage as executives.

- Customers pay no annual fees. Their points don’t expire. The day before a late fee, they get an email alerting them so they can avoid the penalty—an expensive policy for Discover, since late fees could bring in hundreds of millions of dollars in income.

- Discover never sells bad debts to collection agencies.

Customer Love

Customer love blooms with purpose-driven leadership. Meet some of the executives inspiring their teams to lead with love.

These policies and others are the output of an organization built around delighting customers. CEO Roger Hochschild visits each call center at least once each year, holding extensive Q&A sessions. When employees complained that Sunday shifts got overtime but Saturdays did not, executives adjusted wages so that all weekend shifts would be equal. Twice a month, headquarters executives listen to hour-long samples of call center customer interactions. The goal: to determine how they can help the reps delight more customers.

Representatives work in small teams of no more than 16 people, underscoring how vital each member is to the team’s success. They report feeling proud that the company encourages them to help customers however they can. If a customer calls in to request a costly cash advance, for example, reps are trained to check to see if that customer is eligible for a cashback transaction with no fee and no interest instead.

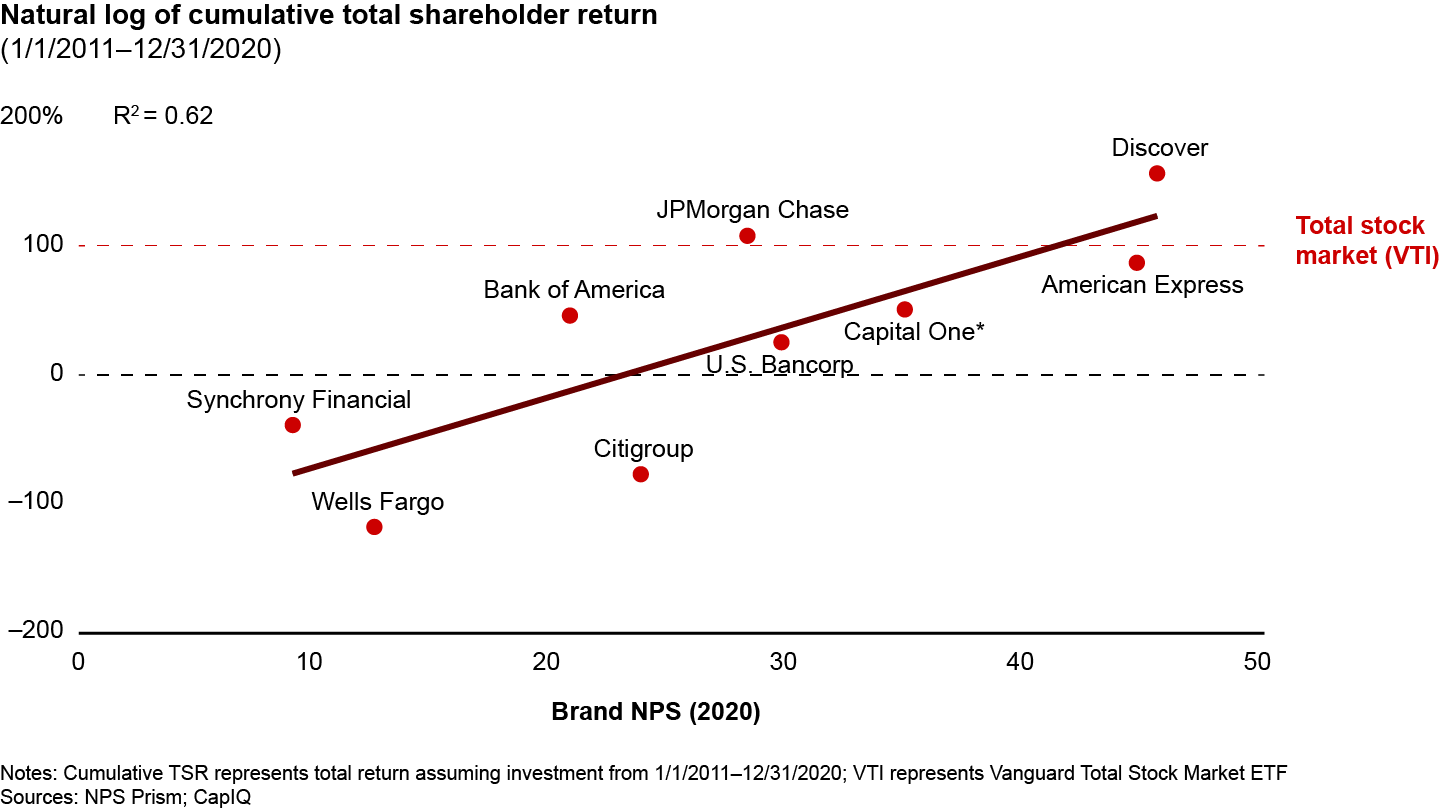

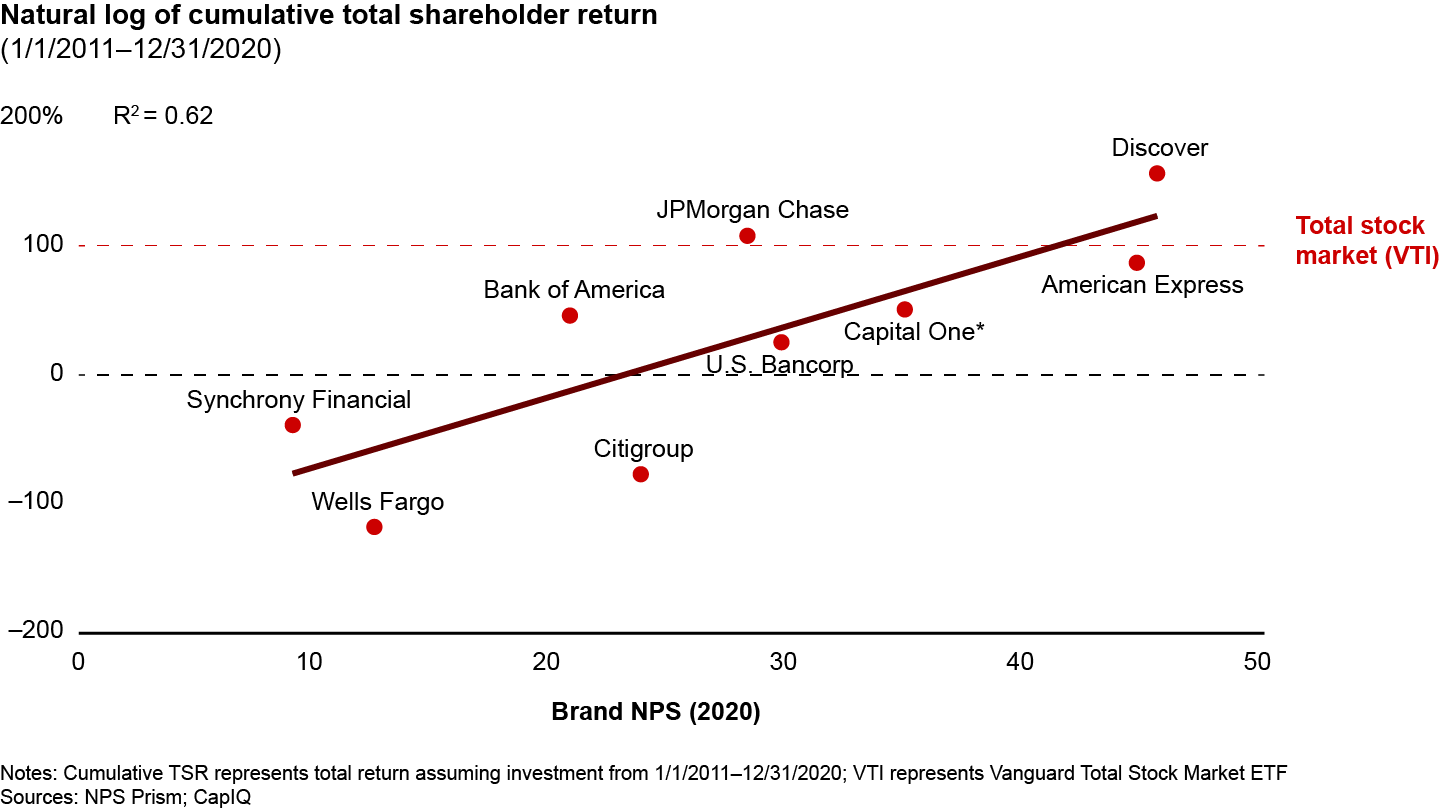

Discover’s approach succeeds not only with retail customers but also with its business clients. Its small and medium size business offerings, for example, have among the highest relationship Net Promoter Score® (NPS) of its peer group, according to NPS Prism® data. And what’s good for customers and employees is good for investors too. From 2011 through 2020, Discover generated the highest total shareholder return in its industry—85 percent greater than the Vanguard Total Stock Market Index Fund.

Want to hear more from today's loyalty leaders?

Explore more episodes of The Customer Confidential Podcast.